Just about everyone in the United States needs a car to get around. The decision…

What is TransUnion® reporting and why does it matter?

Did you know that there are different credit bureaus and each one has their own…

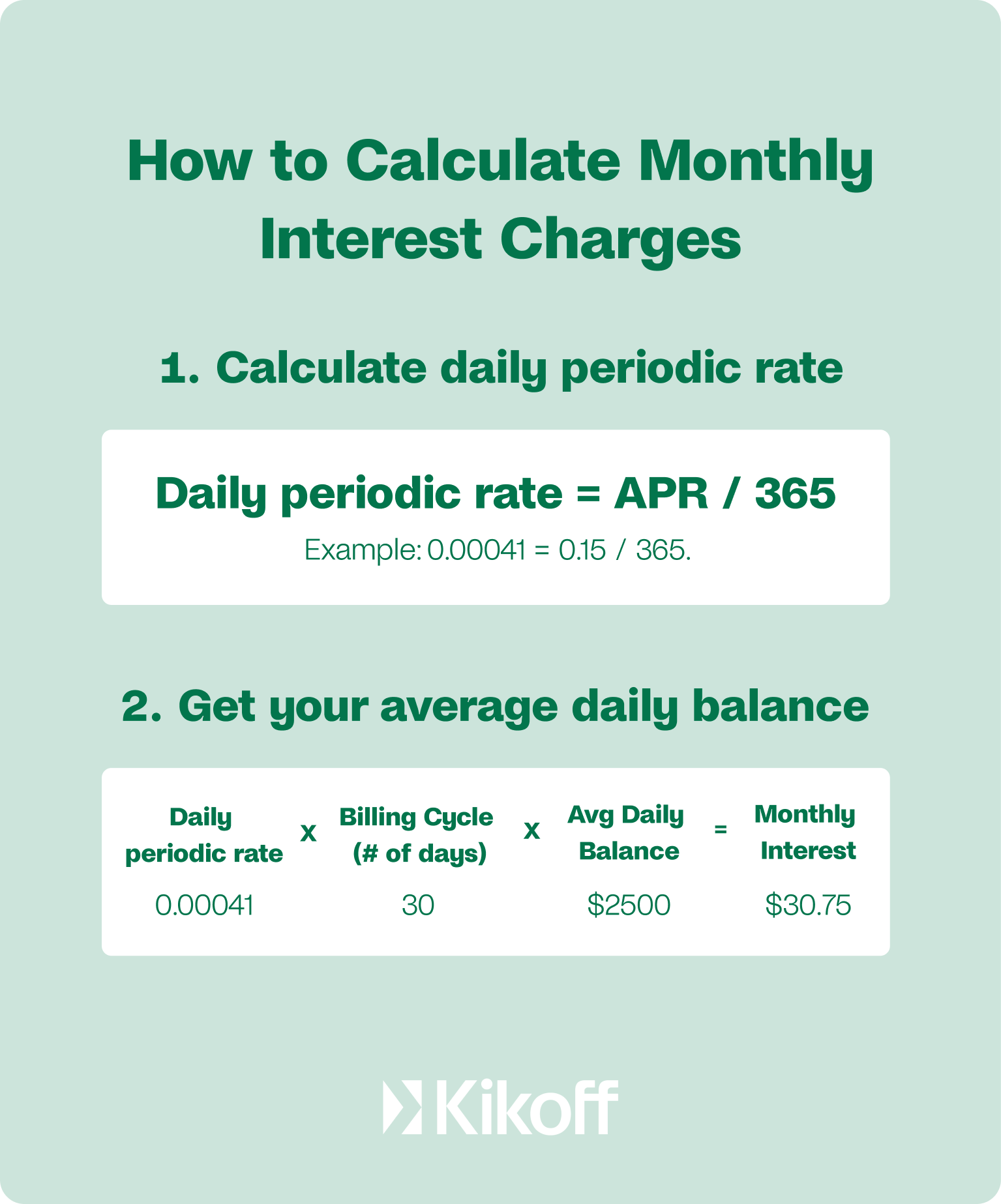

What is APR? How to best calculate APR?

If you’re looking to buy a car, buy a home, or get a loan, you’ll…

Which Product is Right for You: Kikoff’s Credit Account and Kikoff Secured Credit Card

At Kikoff, we understand the importance of establishing a strong credit score for financial success….

Best Credit Cards for Travel Points in 2024

What are the Best Travel Credit Cards for Points in 2024? Choosing the right credit…

Tips for Medical Bills: What is the Minimum Monthly Payment on Medical Bills?

The Burden of Medical Debt in America The American healthcare system is complex and often…

What Is the Highest Credit Score and How Do I Get It?

Credit scores can be complicated and hard to figure out, especially if you are new…

Traveling with Credit Card Points: Where to Start Your Journey

Introduction More people are discovering how to turn everyday purchases with their credit cards into…

How to Start Traveling with Credit Card Points

What Credit Score Do You Need for a Travel Credit Card? When it comes to…

Where Should I Be? Average Credit Score by Age, State, and Income

How do I find out the Average Credit Score by Age, State, and Income? “We…

What Does Inflation Mean for Your Cost of Living and Your Wallet?

In the last 5 years, the price of a gallon of gas has spiked as…

Debt snowball vs avalanche: How to Tackle Your Debt

From credit card debt to student loan payments to mortgage debt, many people have something…

How much does a credit report cost?

Can I Get a Credit Report for Free? “We need credit to do anything nowadays,…

Can You Get Credit Card Approval with No Job?

These days, there are more credit cards than ever and more people with credit cards…