Credit

Continue Reading

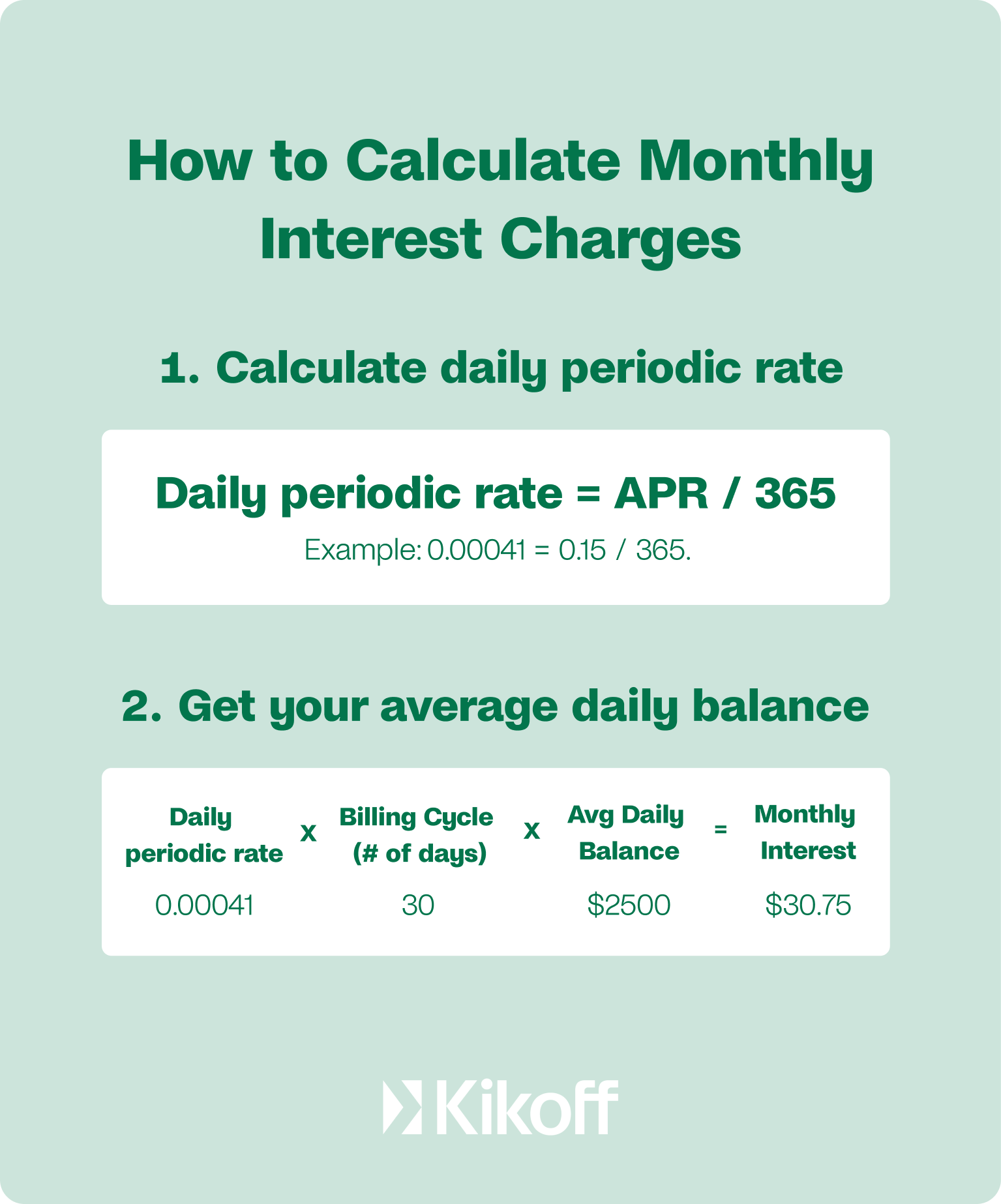

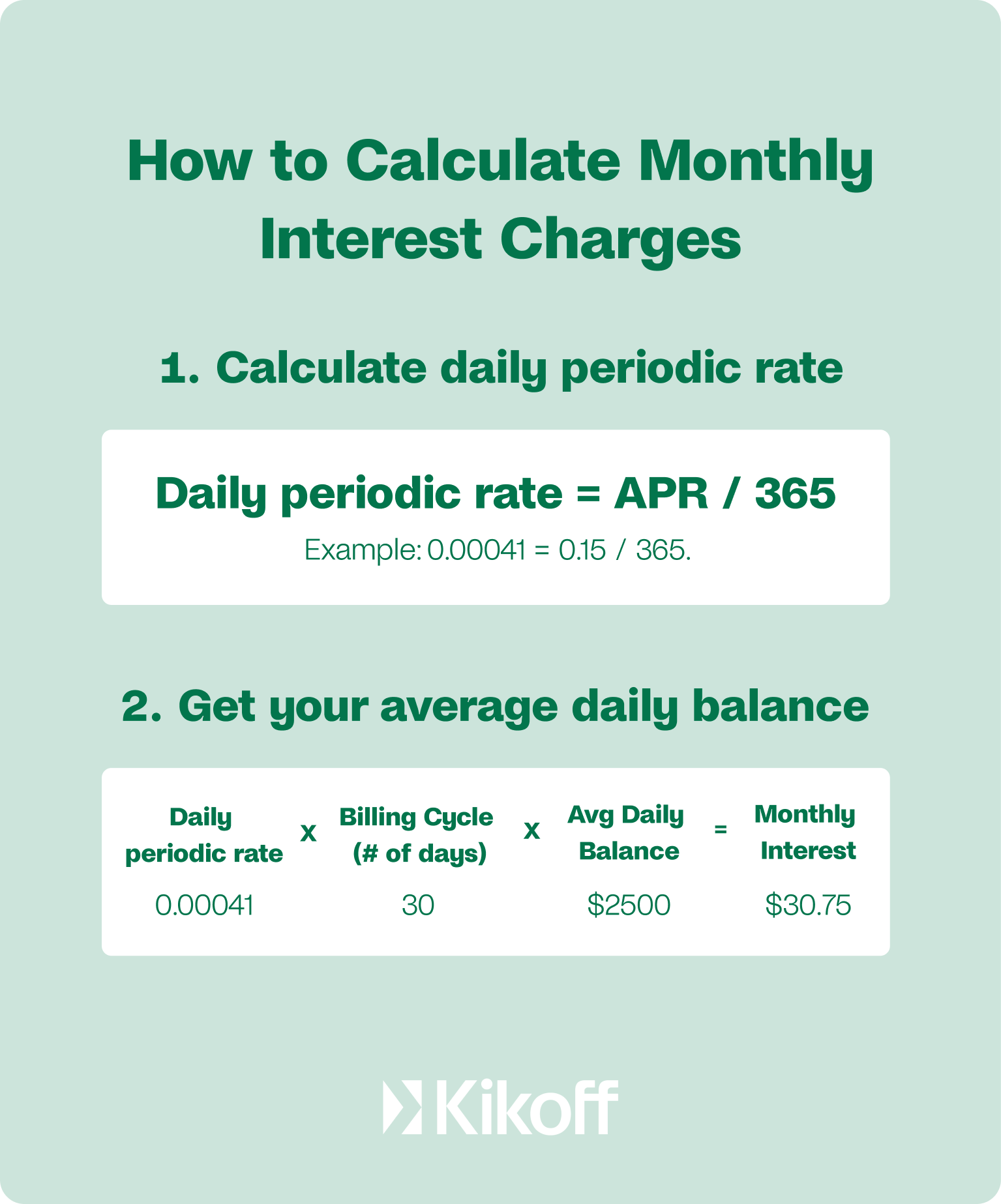

What is APR? How to best calculate APR?

If you’re looking to buy a car, buy a home, or get a loan, you’ll…